Building a digital lending system – from origination to monitoring

In my previous blogpost, I discussed the key aspects of building a digital lending system with a focus on origination and underwriting. Such systems have enabled alternative lenders and fintechs to gain market share by providing customers with a superior experience while also reducing operational costs. That is one part of the digital lending stack, and the easier one. The other, more challenging part of the process, is getting the money back, which is where Monitoring and Relationship Management (MRM) systems come in to optimise collections and recovery.

Beyond the defensive aspects of lending, the right MRM system can be critical in identifying potential issues and opportunities early. As the industry shifts from product-centric to customer-centric banking (e.g. buying a house or growing a business, vs. giving a loan), and focuses on helping customers achieve their goals, a proper MRM system should enable early detection and proactive engagement with customers. Such engagement can help take corrective actions, reduce defaults, increase customer retention, and create cross-sell and upsell opportunities. In other words, MRM systems can focus relationship management on value creation for all parties, rather than technical loan servicing and recovery. Ideally, the system could offer the best next conversation for each customer (borrower) and relationship manager (RM), underpinning the RM of the Future.

Interestingly, a good digital MRM system should be built based on the same principles as the origination system, i.e., capturing customer data seamlessly, generating the right insights from data, designing suitable policies that can be configured and executed automatically, and supporting the internal team and customers with the right tools to act.

In the following example, I’ll illustrate how Open Banking, data insights, and designated workflows could be used to underpin a digital MRM and the RM of the Future. As explained in my previous blogpost, it’s not about tech but rather about helping product managers better understand risk managers and underwriters, and for risk managers to better understand the art of the possible with data and automation, and how to adjust methods and policies for the digital era.

SME credit 101 for product managers

One of the basic questions lenders ask as part of the origination process is "what do you need the loan for?". This question is essential and should be used to match the loan type and amount, as well as help build a richer customer profile over time. In practice, however, this question, and answer, usually falls into a void and is disconnected from the MRM systems.

To understand why SMEs might need credit, the first step is to identify the potential sources of demand, which include financing:

- Cash shortage – to bridge temporary cash inflows/outflows mismatches, handle industry-specific cash flow volatility, and accommodate seasonality

- Growth – including working capital finance, fixed assets and infrastructure, and one-off expenses to support growth

- Losses.

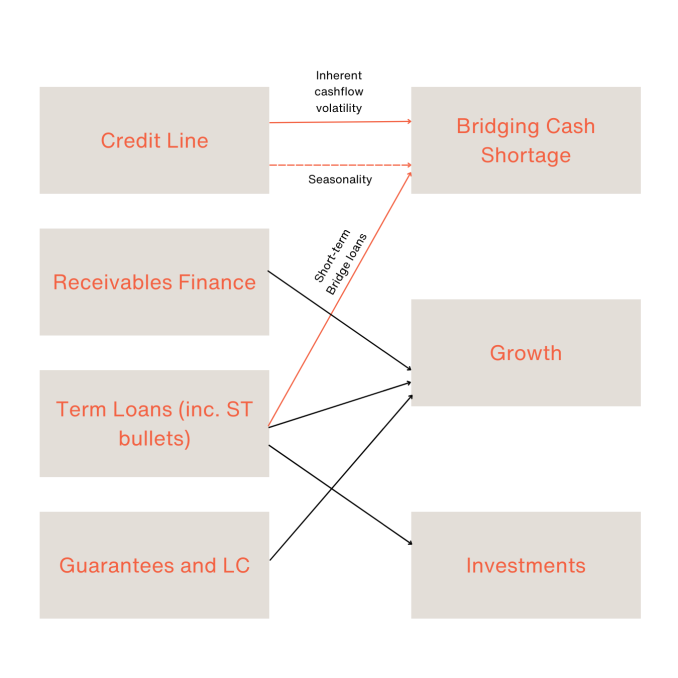

Once the demand for credit is clear, the next step is to understand the supply of credit products that are available to SMEs and how to match the right product for the specific business needs. SME credit products would include credit lines, overdrafts, invoice finance, factoring, bullet and term loans, bank guarantees, and letter-of-credit (LC). These products could address one or more of the sources of demands, as illustrated in the following diagram (red for cashflow-based and black for asset-based):

It's worth noting that the demand for credit and credit mix differs between sectors:

- Retail segments usually require significant investments in infrastructure and other fixed assets and may need trade finance (LC)

- Wholesale/ manufacturing sectors are usually exposed to long cash cycles and require significant trade receivables, in addition to investments in fixed assets, and trade finance

- Project-based industries operate under contracts and require guarantees, contract finance, and investments in fixed assets

- Service providers have shorter cash cycles and may require funding for IT, office renovation, or working capital finance.

By matching the credit products/ mix to the SME specific credit needs, lenders can create a more personalised and effective lending experience. This can improve customer retention, create cross-selling opportunities, and ultimately increase profitability for both the business and the lender.

Open Banking 101 for underwriters

Open Banking (OB), the regulated access to bank transactions via APIs, has been rapidly adopted by lenders and borrowers in the UK. Currently, over 20% of UK lenders use OB as part of their origination and monitoring processes. While the opportunity is clear, it's worth noting that OB's analytics and data insights, especially for SMEs, are still developing and have a long way to go – as many of those lenders still use OB to access raw bank statements to perform the same manual checks, leading to increased underwriting and monitoring times ironically.

An interesting example to consider is affordability assessment based on OB. This typically involves analysing the cash inflows and outflows from bank statements to understand the business's affordability. However, this method can be flawed as it treats cash flow as an accrual-based P&L statement and disregards factors such as growth trends and working capital dynamics, leading to inaccurate conclusions.

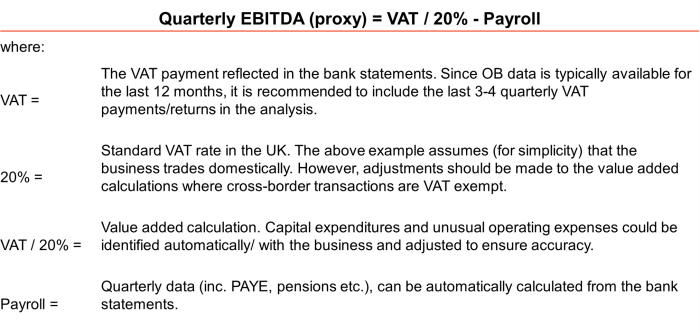

An alternative way to assess an SME affordability based on OB would be:

As the repayments of existing and new loans (principal and interest) can be identified in the bank statements, the different debt coverage ratios can be automatically calculated and monitored in real time.

Bringing it all together

The example above may be simplistic, but it demonstrates how raw data can be converted into valuable and automated insights. OB data can be further enhanced by incorporating open ledger data and CRAs, enabling the generation of more advanced insights, especially when paired with statistical models and machine learning. These insights can then be utilised to trigger alerts for portfolio managers and relationship managers regarding potential risks and opportunities.

At a fundamental level, the MRM system must oversee the financial sustainability of the business and its capacity to fulfill its obligations in the near future. Early detection of risks can allow the lender to work with the company to enhance its cash flow management, profitability, and credit mix as necessary to maintain solvency.

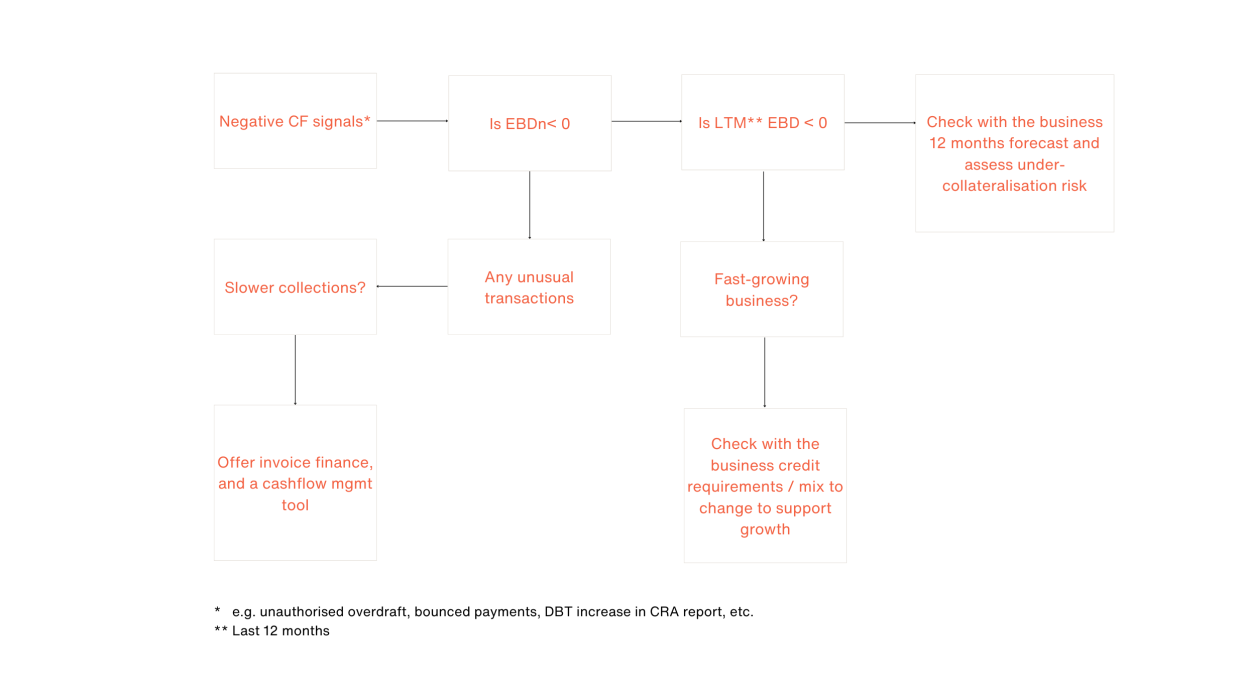

The following flowchart demonstrates how an MRM engine could operate based on the EBITDA calculation from OB (EBD) mentioned above:

This example can be expanded to cover many other advanced end cases. For instance, it could identify opportunities to optimise the credit mix, leading to lower funding costs and improved cashflows. It could also enable underwriting of more credit, support the business with FX hedging and payments, and more.

Consumer Duty

The Consumer Duty is a new regulation that aims to ensure that firms across the financial services industry deliver good outcomes for consumers in retail financial markets. It requires firms to put their customers' needs first and to consider their characteristics, objectives and behavior at every stage of the customer journey.

MRM systems can play an important role in supporting the new Consumer Duty regulation by enabling firms to monitor and manage their customer relationships effectively and proactively. MRM systems can help firms to capture customer data seamlessly, generate insights from data, design and execute suitable policies, and provide tools for internal teams and customers to act. MRM systems can also help firms to demonstrate compliance with the Consumer Duty by providing evidence of good customer outcomes and adherence to the Consumer Principle and the cross-cutting rules.

Aryza Monitor

As an investor in banks, a private credit lender, and a funder to other lending businesses, we have first-hand experience of the challenges and opportunities presented by MRM. With this experience, we have developed with our portfolio company Aryza Monitor. This SaaS platform provides portfolio managers and RMs with a more holistic and real-time view of their portfolios. It allows them to proactively identify and manage evolving risks and act as trusted advisers to their customers.

Moreover, Monitor also features Vantage, an SME-focused solution that enables businesses to effectively manage their cash flows and establish stronger communication channels with their banking partners using the same data. This solution allows lenders to offer SMEs a valuable exchange by accessing and monitoring their internal data sources with their consent.

CreditGPT around the corner

The recent launch of ChatGPT by OpenAI has taken the world by storm and is considered as the "iPhone moment" of AI. This new generation of LLM is accessible to retail and SME users, opening up a world of new opportunities for automation and knowledge democratisation.

Given the pace of change in this space and recent announcements from businesses like Bloomberg and PwC, it is only a matter of time - perhaps just months - before we see LLM applications for credit origination and MRM. These applications could cover many, if not all, of the points mentioned in the above example and evolve into CreditGPT and RM-GPT. While it may not make RMs redundant, it will undoubtedly change the ways they interact with their portfolios and the value they can create.